Identity Fraud Detection

and Prevention Solutions

Detect and prevent identity fraud at every stage with real-time insights and advanced analytics. Reveal true identities behind account creation, logins, and transactions. Enhance trusted users' experience and protect them from scams.

- Block synthetic or stolen identities with intelligent risk detection across personal data, online footprints, and behaviors.

- Use Sardine's True Piercing™ to reveal fraudsters' true identity, location, IP, device, and merchant risk rating.

- Monitor user behavior, device signals, and identity data to prevent account takeovers, money muling, and suspicious transfers.

- Fast track trusted users, reduce false positives, and approve more genuine customers.

See Sardine in Action

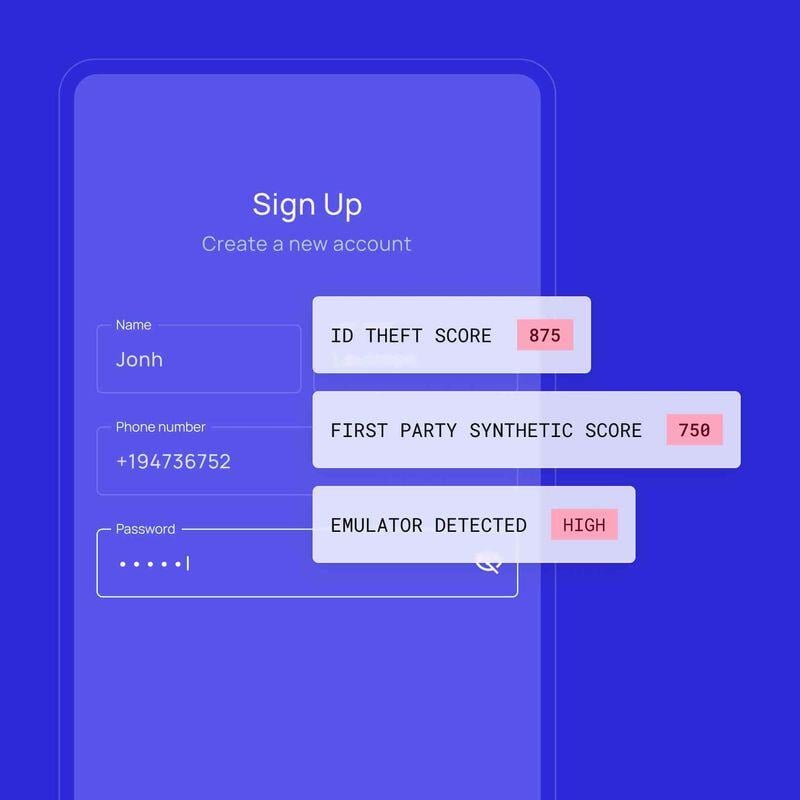

Detect When Scammers are Impersonating Your Users

Stop Identity and Device Obfuscation

Catch Fishy and Bot-Like Behavior

Analyze Suspicious Relationships

Trigger Additional Verifications

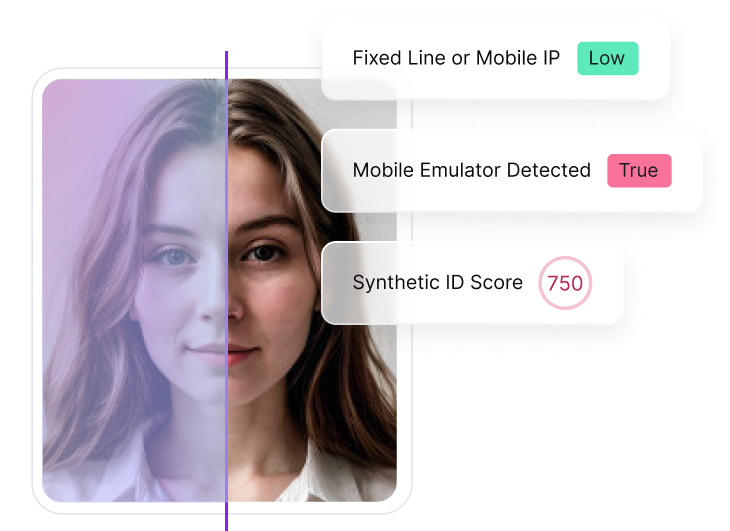

Prevent Fraudsters from Using

Synthetic or Stolen Identities

Detect identity fraud by monitoring known data breaches, use Sardine's machine learning to identify suspicious patterns, and recognize true names associated with stolen tax IDs, as well as synthetic identities created with fake details.

- Stop fraud at account creation to reduce fraud losses and avoid costly recoveries

- Prevent stolen identity misuse to protect customer trust and minimize reputation risk

- Continuously refine fraud detection with machine learning that evolves with new identity fraud tactics

Fast-Track Trusted Users and Approve Genuine Transactions

Enhance user experience and drive growth by enabling frictionless access for trustworthy identities, while minimizing risk.

- Reduce friction for legitimate identities during signup, login, and app interactions to drive new users

- Streamline user flow by bypassing additional security steps (OTP, 2FA) for verified identities to maintain a smooth experience

- Retain loyal customers and maximize revenue by offering increased limits and privileges for trusted users without overly restrictive rules, without increased fraud risk

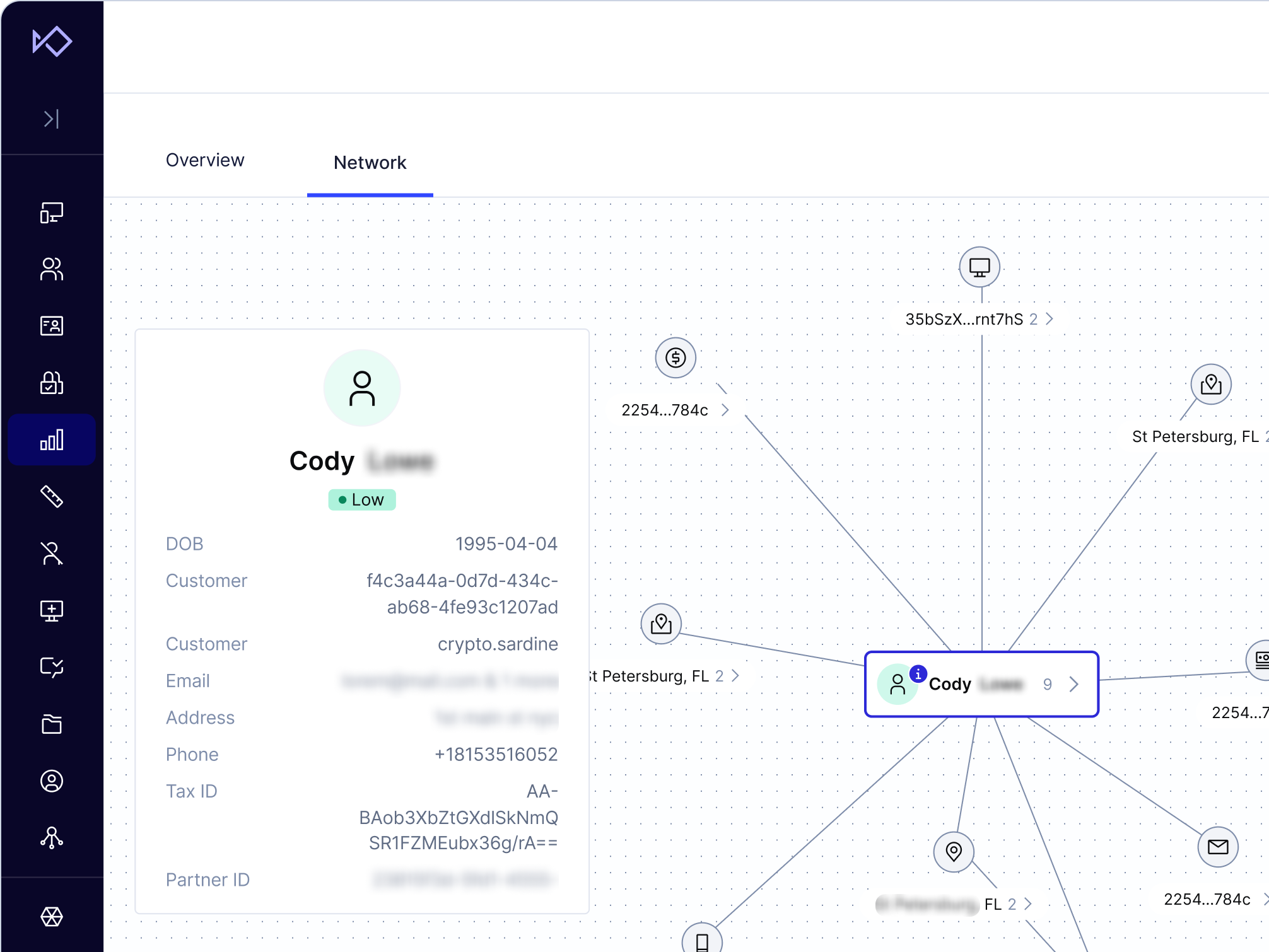

Equip Your Team with Powerful Fraud Investigation Tools

Empower your team with a full set of tools to identify, analyze, and respond to fraud efficiently.

- Leverage our modular customer dashboard with a built-in risk engine and investigation tools for seamless case management

- Uncover suspicious patterns and fraud rings with the Network Graph, visualizing connections between users and data points

- Create custom rules and workflows with the No-Code Rules Editor, utilizing over 4,000 fraud detection features without any coding

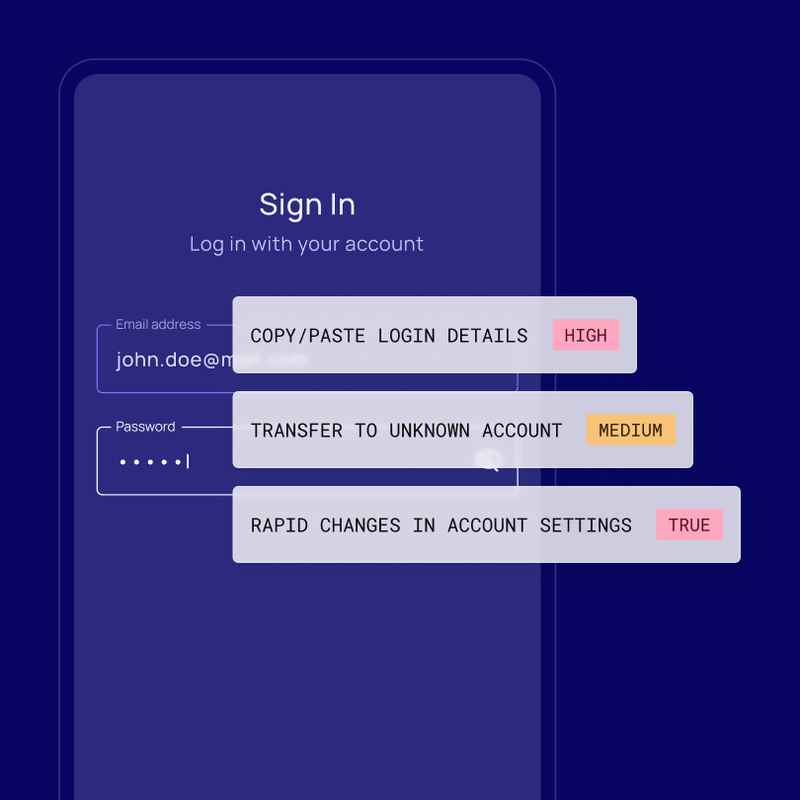

Stop Fraudsters at Every Step of the Money Mule Journey

Combat fraud during account creation, detect ownership changes through new IPs or linked accounts, flag suspicious logins from unusual devices, and halt scams in progress by recognizing remote access tools and erratic behavior.

- Protect against fraud in account creation and onboarding

- Monitor for risky account handoffs and suspicious ownership changes

- Prevent account takeovers with continuous monitoring

-

Mitigate social engineering risks with real-time

behavior analysis

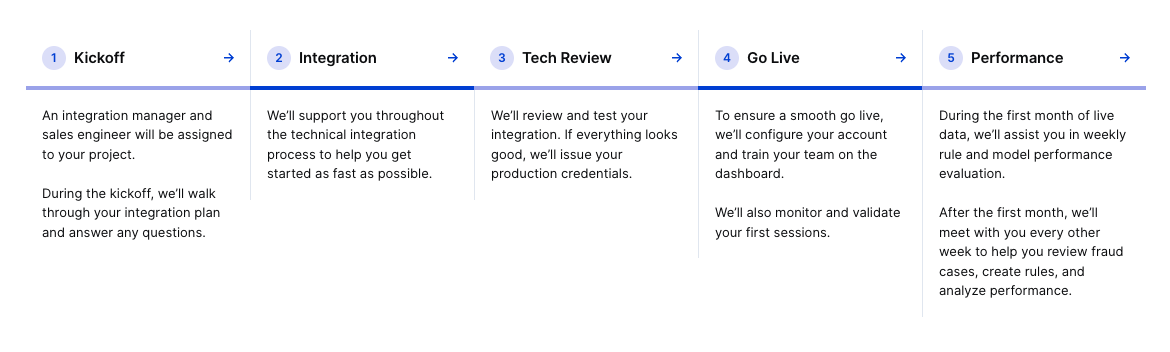

Get Started with an Easy, Low-Lift Integration

Our integration requires minimal engineering resources. We develop a customized integration plan and offer support at every stage. Sardine also handles system configuration and assists with migrating rules from your current provider.

One Unified Platform for Identity Verification

Thorough Customer Identification

All Your Data in One Interface

Stop Risky Users from Onboarding

Assess Risk Exposure in Real-Time

Sardine is modernizing the way we fight fraud. Their deep insights and proactive detection allow us to stay ahead of emerging threats, without juggling multiple vendors.

35%

Account Takeover Reduction

95%

Remote Desktop Capture Rate

230%

3-year Return on Investment

See Sardine in Action

Ready to see Sardine in action? Let's set up a custom demo focused on your needs.