Fake Account & Free Trial Abuse Solutions

Combat fake account creation, free trial abuse, and fraudulent sign-ups with Sardine’s real-time fraud prevention solutions.

- Continuously monitor and analyze user behavior, device signals, and identity data to identify abuse patterns

- Use Sardine's True Piercing™ to reveal fraudsters' true identity, location, IP, device, and merchant risk rating

- Stop account takeovers, bot-driven abuses, and suspicious account activities before they escalate.

-

Fast track trusted users, reduce false positives,

and approve more genuine customers

Trusted by Hundreds of Industry Leaders, Including:

See Sardine in Action

The Smartest Signals for Tackling Complex Account Fraud

Catch the Earliest Signs of Fraud

Detect device IDs, browser user-agents, and variances in actual vs. stated time zones, operating systems, geos, and IP addresses.

Know Fraudster's Signature Moves

Spot irregularities in typing speed, mouse movements, scroll/swipe patterns, context switching, and other unusual behaviors.

Stay Ahead of

Evolving Threats

Block emulators, RATs, tampered apps, VPNs/proxies, session hijacking, jailbroken devices, MITM attacks, and bots.

Sardine lowered our ACH fraud rates by 60%. We've consistently observed that behavior data provides the strongest fraud signals at account opening.

Brex

.webp)

Prevent Fraud at Every Customer Touchpoint

- Account Creation: Prevent fake accounts with synthetic of stolen identities. Detect when mobile emulators, virtual machines, device farms, or automated scripts are used during sign ups.

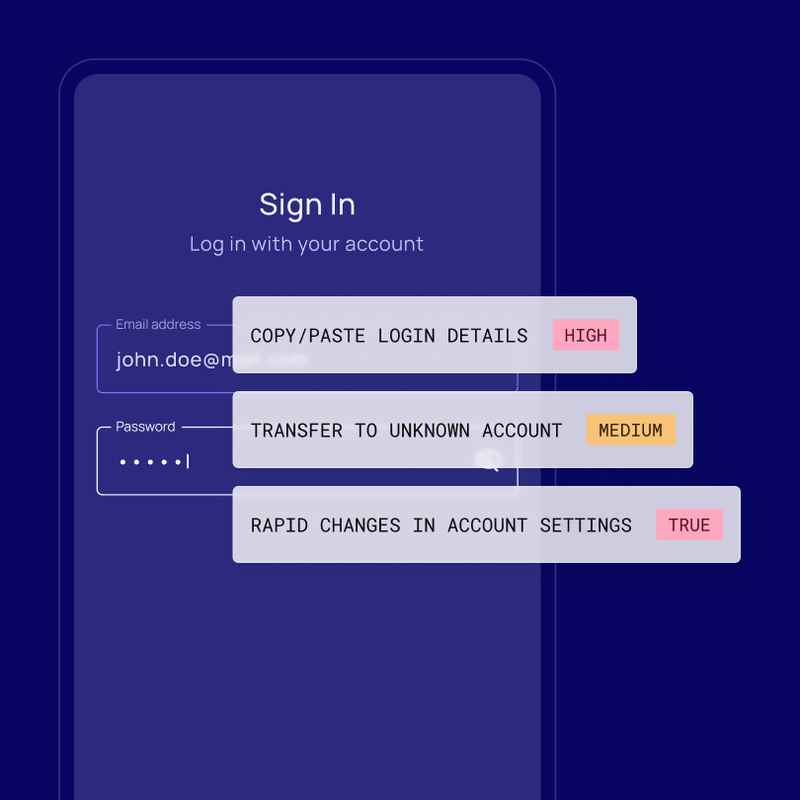

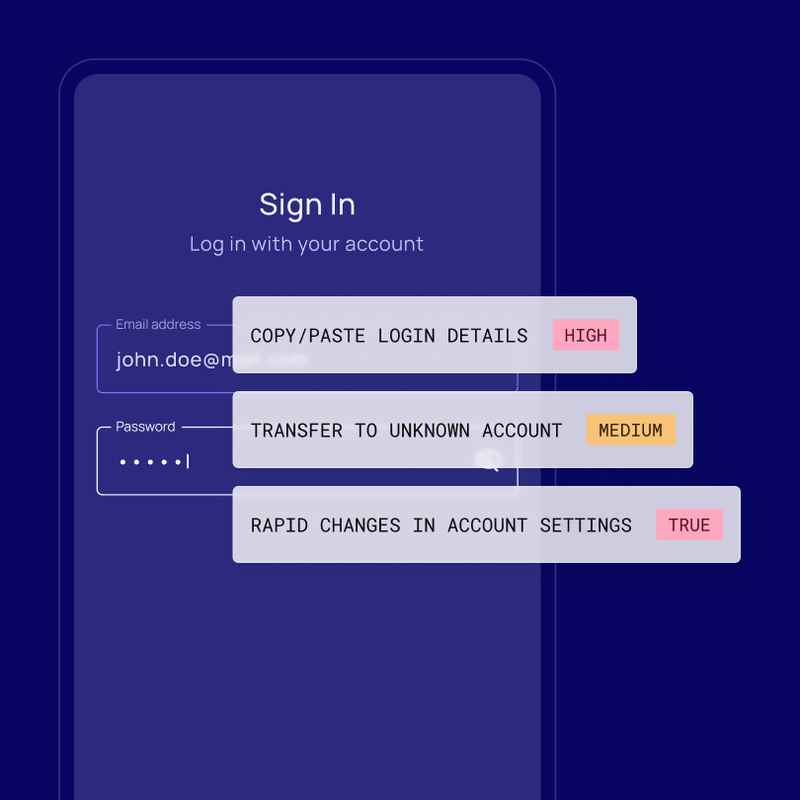

- Account Login: Catch signs of unauthorized users like tab switching, password pasting, unknown logins, stressed typing, and suspicious account changes.

-

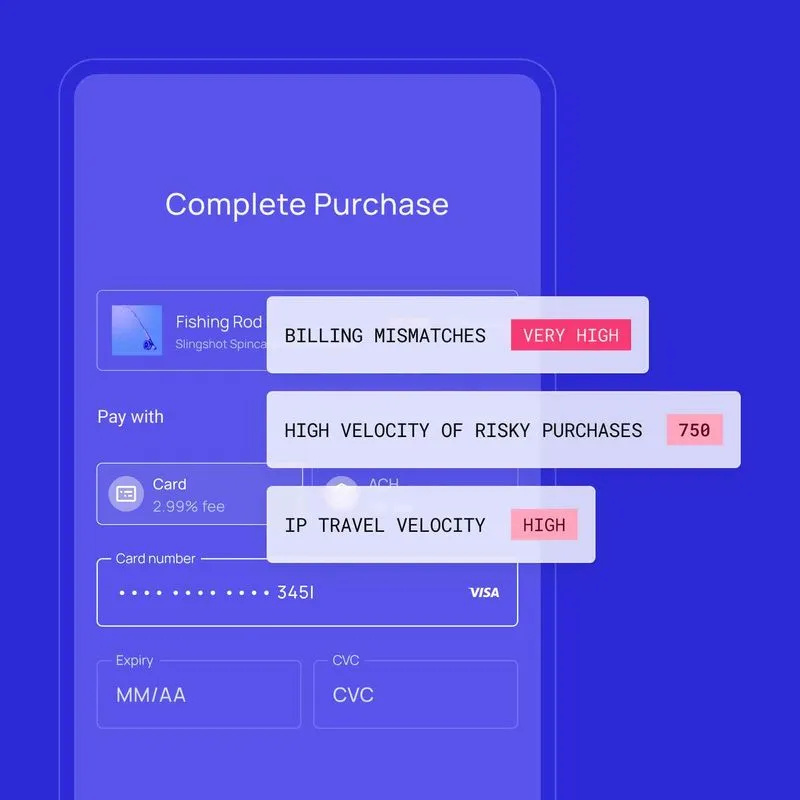

Payments: Prevent chargebacks by identifying suspicious patterns, mismatched billing details, and unusual behaviors like card testing or high transaction velocity.

- Capture four different identifiers for profiled devices: Device ID, Device Fingerprint, Mobile User ID, and Account Device ID.

Combine Powerful Device and Behavior Signlas

- Enhance conversion with passive device and behavior signals, enabling low-friction onboarding for trusted customers

- Reduce false positives by analyzing hundreds of device and behavior signals to avoid auto-declining good customers

- Drive operational efficiency and reduce tech debt by unifying device and behavior providers

Expose Fraudsters with Persistent Device Identifiers

- Capture four different identifiers for profiled devices: Device ID, Device Fingerprint, Mobile User ID, and Account Device ID.

- Identifiers are persistent and will survive even if a user factory resets or uninstalls/reinstalls your app on their phone.

-

Detect jailbroken or rooted devices if a user tries to manipulate identifiers.

- Sardine supports Apple DeviceCheck to confirm if the user is on a reused Apple Device.

Protect Customers' Funds from Growing Scams

- Suspicious User Behavior: Identify active scam indicators like ongoing calls, screenshot captures, guided mouse movements, and hurried typing.

- Remote Desktop Detection: Detect remote access tools like TeamViewer, AnyDesk, or Citrix, commonly used in romance, crypto advisor, and customer support scams.

- Anomalous Transactions: Get real-time alerts on transfers to unknown accounts, unusual payment velocity, impossible location changes, or activity during odd hours.

Device and Behavior Signals for Advanced Fraud Detection

Behavior Biometrics

-

Typing and mouse movement

-

Scrolling and swiping

-

Copy, paste, and autofill

-

Hesitation and distraction events

-

Long-term memory field input

-

Same user scores

-

Record and replay

-

Screenshot capture

Device Intelligence

-

Device and browser fingerprints

-

TrueIP, TrueOS, and TrueAge

-

GeoIP and location compliance

-

Emulator and virtual machine

-

Bot activity

-

Proxy/VPN usage

-

Remote access tools (RAT)

-

Tampered apps and rooted devices

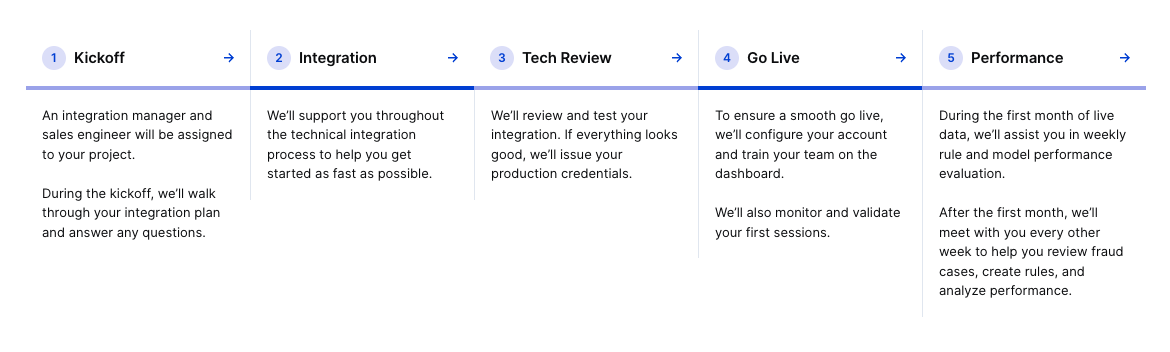

Get Started with an Easy, Low-Lift Integration

Our integration requires minimal engineering resources. We develop a customized integration plan and offer support at every stage. Sardine also handles system configuration and assists with migrating rules from your current provider.

Block Account Fraud Without Adding Friction

Continuously Monitor All Sessions

Learn the user’s device and behavior patterns, and build a holistic customer profile.

Patented True Piercing™ Technology

Unmask fraudsters hiding behind obfuscated devices while transacting or creating new accounts.

Combine Device and Behavior

Leverage one solution, reduce visibility gaps of point solutions to improve risk scoring.

Avoid Extra Costs

Reduce friction for genuine users by avoiding redundant security steps like OTP, 2FA, or reCAPTCHA.

Behavioral biometrics is fundamental to fraud prevention. Deploying it throughout the user journey helps our customers deal with increasingly complex fraud attacks.

Eduardo Castro

Manager Director, Identity and Fraud | Experian

Forrester's Total Economic Impact study on Sardine finds that average customer achieves:

$2.3 Million

in Reduced Losses

$2.4 Million

in Operational Savings

$5.1 Million

3-year Return on Investment

See Sardine in Action

Ready to see Sardine in action? Let's set up a custom demo focused on your needs.