Automate KYC & AML Compliance with AI-Driven Risk Intelligence

Manage KYC, AML transaction monitoring, case management and SAR filings from one platform.

- Configure custom KYC workflows with step-ups for risk-based identity verification

- Monitor AML & sanctions risks dynamically, with real-time AI models adapting to emerging threats

- Eliminate manual compliance bottlenecks—AI Agents handle alerts, case reviews, SAR filings, and fraud escalation

Automate Compliance with AI

Optimized Compliance with Progressive KYC and KYB

Enhance your KYC and KYB process, monitor for risk events, and get real-time feedback on compliance program performance.

Pre-screening

KYC and KYB

Step-up Verification

Continuous Monitoring

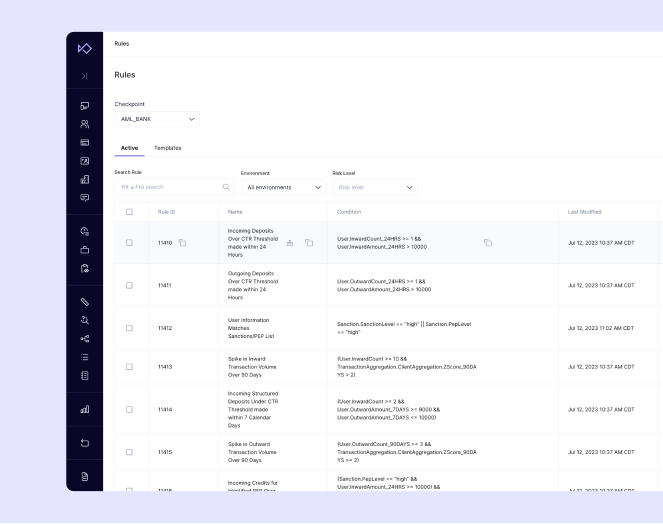

AML Transaction Monitoring

Proactively block risky transactions with real-time and batch transaction monitoring rules. Sardine supports your BSA/AML requirements and comes bundled with over 1,000 pre-built rules for AML/CTF.

Leverage our low-code rules editor to create custom rules, trial them in shadow mode, or back test them against your historical transactions.

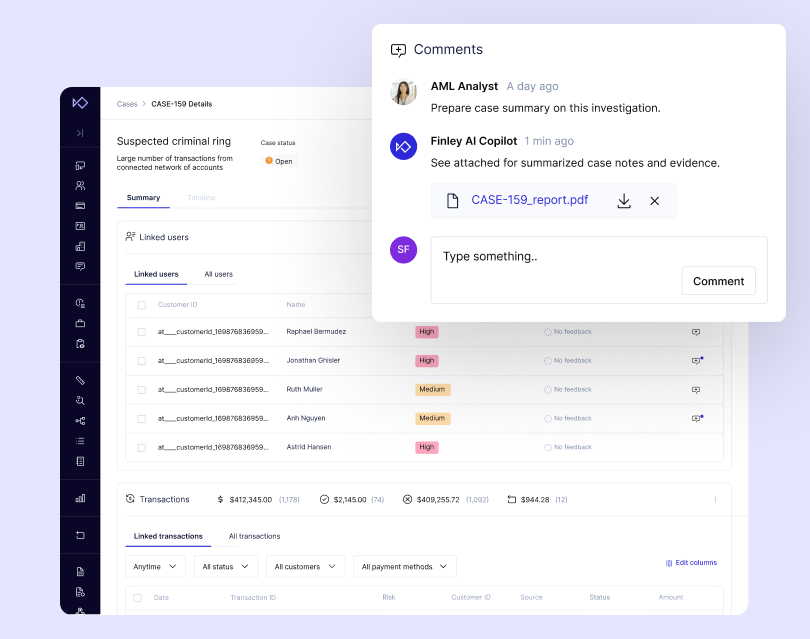

Case Management

Our AI agents to help you review cases, convert text into SQL rules, automate manual batch jobs, write SAR narratives, and automate file them.

- Streamline FinCEN reporting for CTRs, STRs, SARs, WTRs, and TBRs

- Automate alert triage to reduce noise and ensure attention to high-priority cases

- Accelerate case handling to improve team productivity and response times

- Reduce time spent on cases by enabling faster, more effective investigations

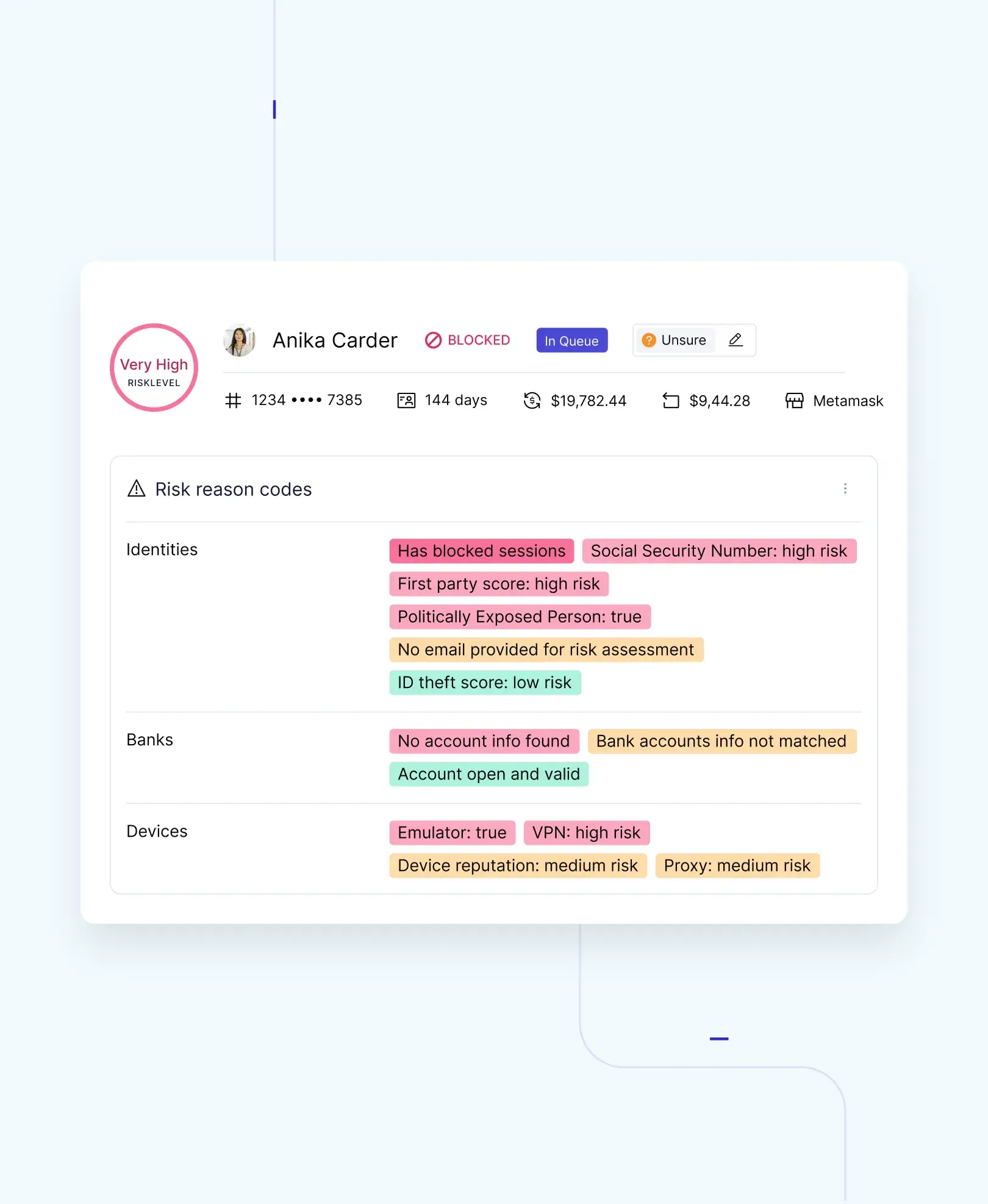

Global Watchlist Screening and Ongoing Monitoring

Screen clients against watchlists with advanced thresholds to reduce false positives, review genuine matches, and receive real-time alerts if a user is added to a watchlist.

-

Office of Foreign Assets Control (OFAC)

-

Politically Exposed Persons (PEP)

-

Specially Designated Nationals (SDN)

- Adverse Media

Continuous Effectiveness Testing

Enhance your oversight with real-time model validation against historical and labeled data, pinpointing control gaps across your business or sponsored programs. Replace manual checks with real-time alerts for OFAC screening, CIP, and BSA/AML, ensuring swift and accurate compliance.

Automated Oversight

Real-Time Testing

Quality Assurance

Insight-Based Suggestions

Sardine breaks down data silos and enables our teams to efficiently identify issues for remediation and quickly pull together and share relevant data for further audit, examination, and regulatory purposes as needed.

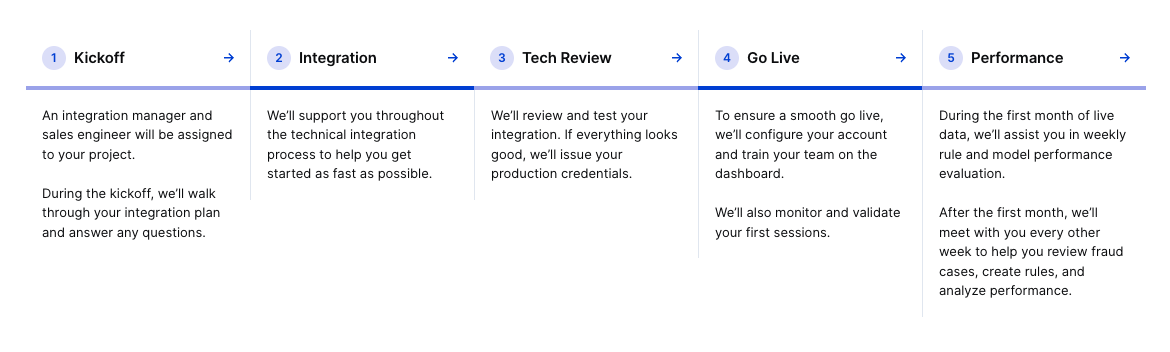

Get Started with an Easy, Low-Lift Integration

Our integration requires minimal engineering resources. We develop a customized integration plan and offer support at every stage. Sardine also handles system configuration and assists with migrating rules from your current provider.

$2.3 Million

in Reduced Losses

$2.4 Million

in Operational Savings

50% Less

Case Workload

See Sardine in Action

Ready to see Sardine in action? Let's set up a custom demo focused on your needs.