Payment Fraud Prevention Solutions

Stay ahead of fraud with real-time, end-to-end protection for every transaction stage. Our platform, built for financial services and e-commerce, combines machine learning, device intelligence, and behavior insights to safeguard revenue and enhance customer experiences.

- Utilize frictionless pre-authorization screening to filter out bad actors prior to transactions.

- Prevent fraud across all payment types—card, ACH, wire, RTP, and more. Predict the likelihood that a transaction will result in a chargeback or ACH return.

- Use device & behavior signals + card identity matching to reduce false positives and capture more revenue by auto verifying incorrectly flagged transactions.

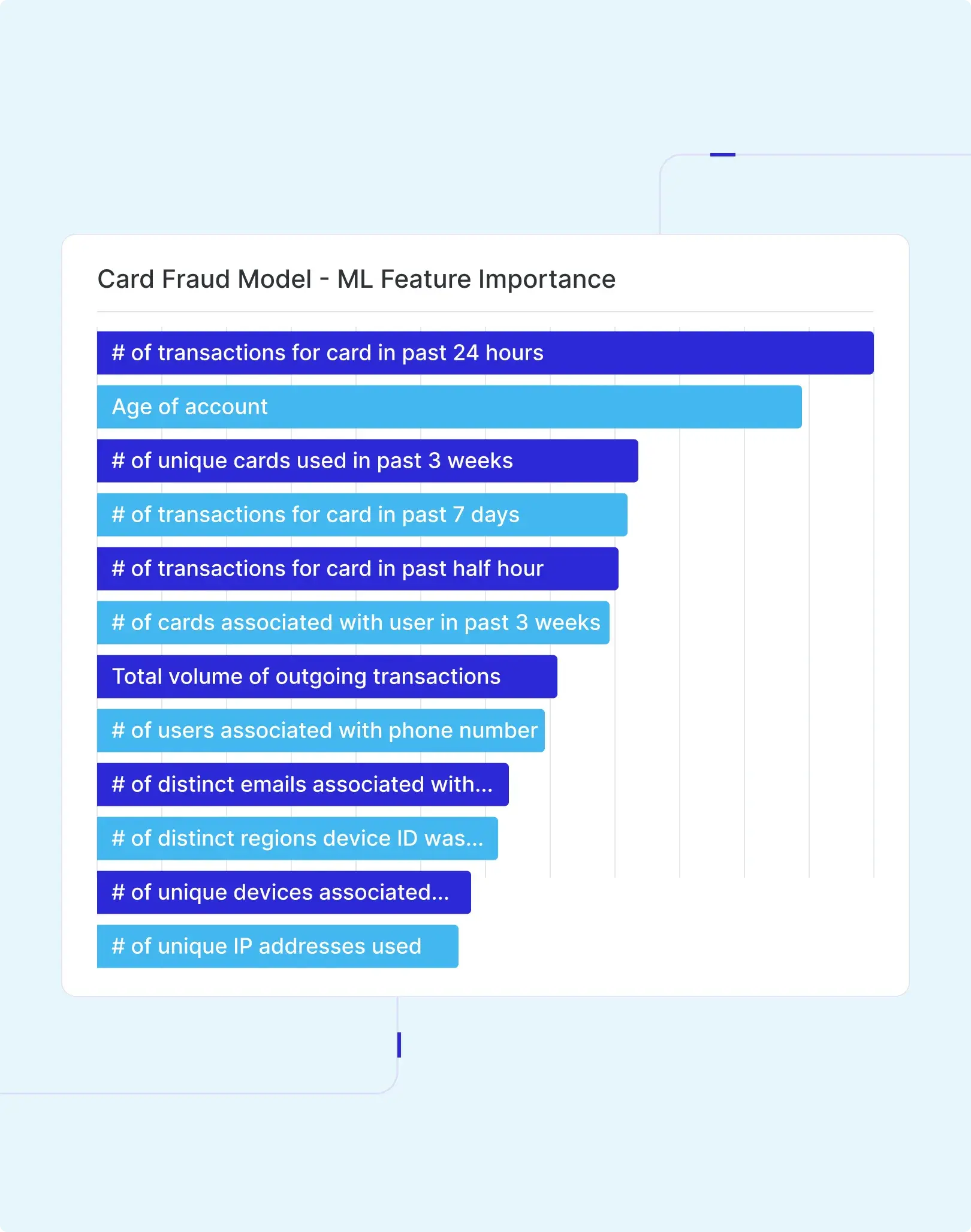

- Deploy custom ML models to predict chargebacks, ACH returns, and other fraud types, with full transparency and customization to suit you needs.

Trusted by Hundreds of Industry Leaders, Including:

See Sardine in Action

Guard Against Diverse Forms of Payment Fraud

ACH Kiting

Detect rapid ACH debit and credit sequences across accounts that suggest float time manipulation.

Money Mules

Monitor for money muling indicators, like large or frequent deposits followed by transfers to unrelated external accounts.

Stolen Cards

Identify stolen card indicators, like sudden transaction spikes or inconsistent geo activity.

Card Cloning

Spot cloned card signals, like identical card details used in multiple quick, in-person transactions.

Card Testing

Stop carding attacks by picking up on patterns related to card testing, like numerous small transactions followed by larger purchases.

APP Scams

Detect abnormal mobile app activity, like inconsistent device signatures or erratic transaction patterns.

Safeguard Card Transactions Against Advanced Fraud

- Identify Stolen Card Use and Testing: Detect and block stolen card attempts and card testing patterns to prevent unauthorized access.

- Prevent Chargebacks from Friendly Fraud: Reduce losses by distinguishing legitimate disputes from fraudulent chargebacks.

- Stop Cloning and Skimming Attempts: Monitor for cloning and skimming behaviors to halt fraud before it impacts your customers.

Lower Unauthorized ACH and NSF Returns

- ACH transaction risk scoring: Our machine learning models use thousands of fraud features to predict unauthorized ACH returns (R05, R07, R10, R11, R29).

- Non Sufficient Funds (NSF) Risk Prediction: Custom ML model predicts NSF returns (R01, R09) using balance, transaction history, contact data, network signals, device ID, and behavioral biometrics.

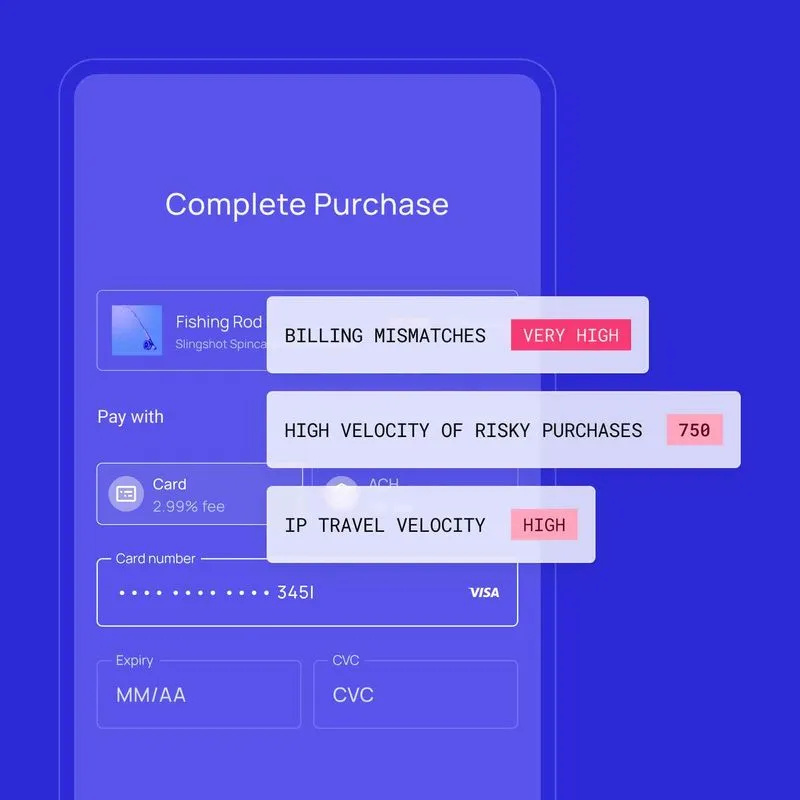

Defend Against Card-Not-Present Fraud

- Checkout Behavior Analysis: Identify unusual behaviors like auto-fill vs. copy-paste, typing patterns, and hesitation to detect potential fraud.

- Post-Transaction Refund Fraud: Analyze transaction history, refund patterns, and suspicious behaviors following purchases to block fraudulent refund requests.

- Device Risk Assessment: Use device fingerprinting, velocity checks, and bot detection to flag risky devices, including emulators and virtual machines.

- Shipping Address Analytics: Monitor discrepancies in shipping addresses, like PO boxes or drop-ship locations, to verify true customer locations.

.avif)

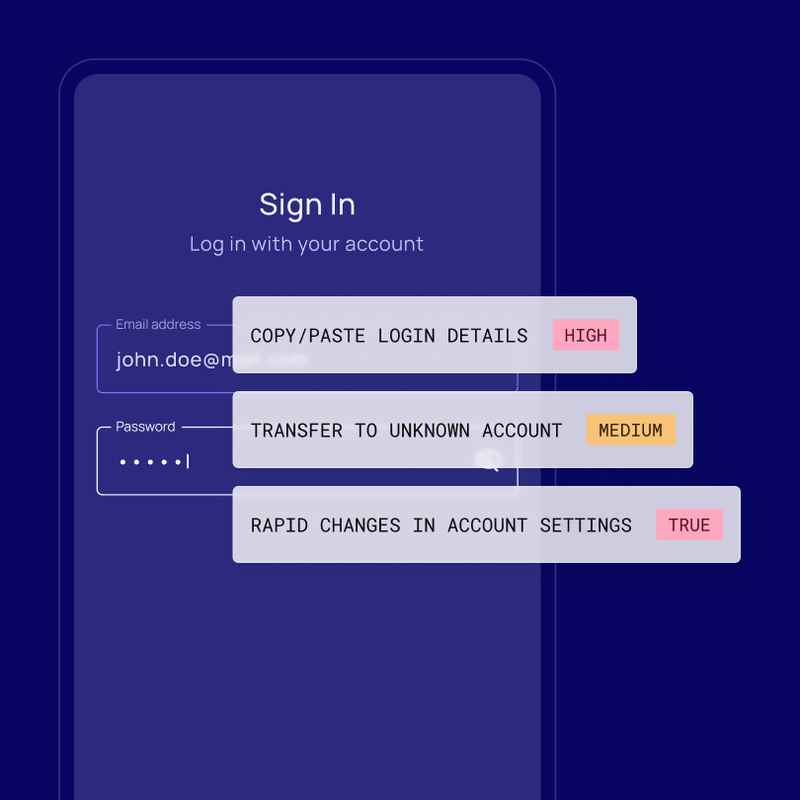

Protect Customers' Funds from Growing Scams

- Anomalous Transactions: Get real-time alerts on transfers to unknown accounts, unusual payment velocity, impossible location changes, or activity during odd hours.

- Suspicious User Behavior: Identify active scam indicators like ongoing calls, screenshot captures, guided mouse movements, and hurried typing.

- Remote Desktop Detection: Detect remote access tools like TeamViewer, AnyDesk, or Citrix, commonly used in romance, crypto advisor, and customer support scams.

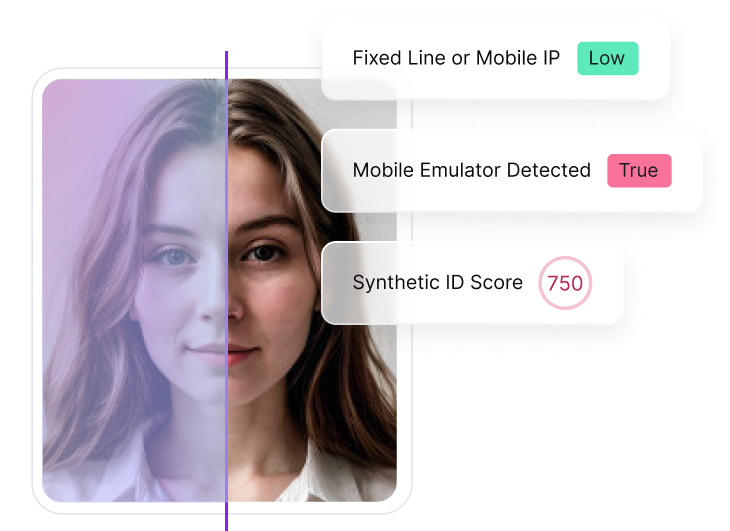

Block High-Risk Customers Before They Transact

- Device Intelligence: Identify suspicious device traits like emulators, proxies, VPNs, or IP, GPS, and address mismatches.

- Behavior Biometrics: Flag risky behaviors like pasting long-term memory fields, excessive tab switching, or expert-level mouse movements.

- Identity Verification: Detect stolen tax IDs, synthetic identities, and rapid sign-ups from the same device or IP.

Validate Account Status and Ownership in Real-Time

- Bank Account Authentication: Verify account ownership or authorization by checking national databases.

- Bank account verification: Validate ownership and account status via bank and routing numbers before approving deposits or payments.

Block Fraud Without Adding Friction

Avoid Extra Costs

Speed up checkout for genuine users without redundant security steps like OTP, 2FA, or reCAPTCHA.

Capture More Revenue

Prevent revenue loss from overly conservative rules that block legitimate transactions.

Increase Loyalty

Increase AOV and speed up transactions by offering higher purchase limits to low-risk users.

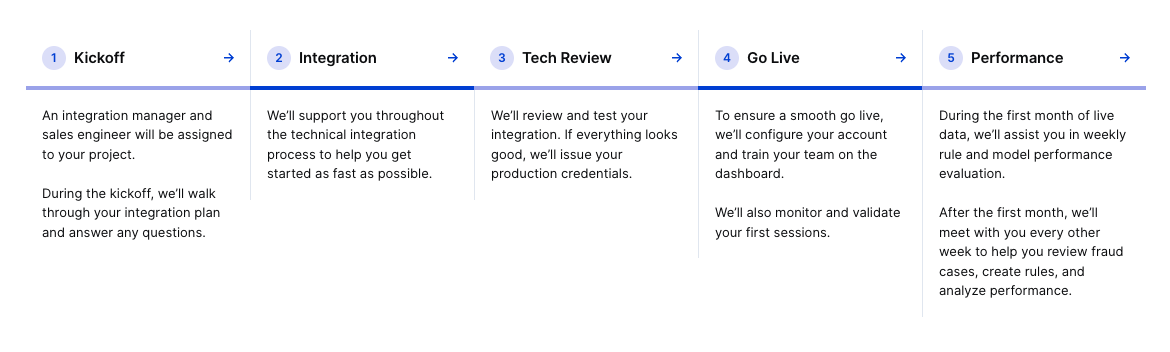

Get Started with an Easy, Low-Lift Integration

Our integration requires minimal engineering resources. We develop a customized integration plan and offer support at every stage. Sardine also handles system configuration and assists with migrating rules from your current provider.

Behavioral biometrics is fundamental to fraud prevention. Deploying it throughout the user journey helps our customers deal with increasingly complex fraud attacks.

Eduardo Castro

Manager Director, Identity and Fraud | Experian

Forrester's Total Economic Impact study on Sardine finds that average customer achieves:

$2.3 Million

in Reduced Losses

$2.4 Million

in Operational Savings

$5.1 Million

3-year Return on Investment

See Sardine in Action

Ready to see Sardine in action? Let's set up a custom demo focused on your needs.